Case Study

ABOUT CUSTOMER

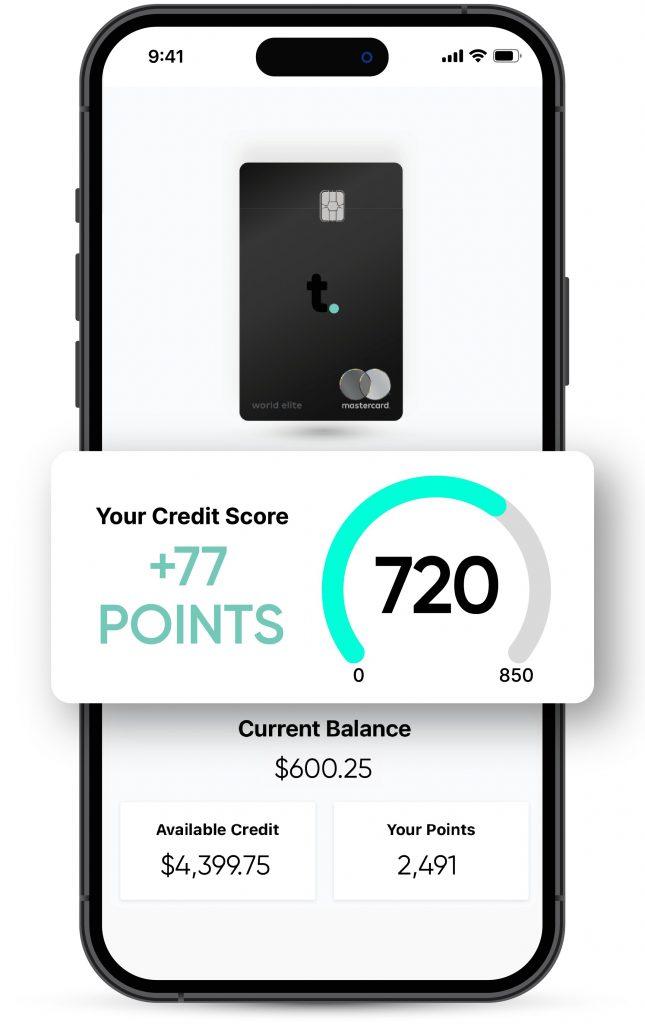

Disrupting the traditional FICO-driven credit market with innovation

TomoCredit, a Series B fintech startup, provides credit to individuals with little or no credit history using their proprietary underwriting algorithm to identify ‘high potential borrowers’. Since engaging APEX for accounting and FP&A services in early 2021, TomoCredit has received over 2.5 million credit card applications and raised $22M in Series B funding and $100M in debt financing in July 2022

DETAILS

Taking Backbone of the Company to The Next Level

CHALLENGE

When TomoCredit engaged APEX, they had recently raised their Series A and were preparing for their Series B. They were working with an outsourced accounting firm and a fractional CFO, but their accounting books contained little to no data to prepare a good financial model and existing financial model was in a poor shape. Additionally, their investor deck lacked content and a clear strategy to address investor questions, making it difficult to secure funding from sophisticated growth stage VCs and corporate venture capitalists

SOLUTION

Aside from handling day-to-day accounting and FP&A tasks such as conducting 409A valuations and monthly book close processes, APEX played a leading role in polishing TomoCredit’s historical financials, creating investor deck and financial model from scratch in preparation for their Series B fundraising. APEX was also heavily involved in attending all investor meetings alongside the founder, acting as interim CFO throughout the fundraising process